Planned Giving

What Will Your MBL Legacy Be?

Support the Marine Biological Laboratory’s Future Through Legacy Giving

LEGACY GIVING is one of the most impactful ways you can support the Marine Biological Laboratory’s critical research and education mission. You may be able to save on taxes, receive income for life, or enjoy other financial benefits for you and your loved ones — all while ensuring MBL’s basic science continues to lead the way for years to come. Explore ways to have a lasting impact on the future of the MBL while ensuring the best fit for your philanthropic goals and financial situation.

Ways to Leave a Legacy:

One of the simplest ways to leave an enduring impact on the MBL is a gift from your will, living trust, life insurance policy, or retirement plan. A bequest can be made with cash, securities, real estate, or other assets and be in the form of a dollar amount, specific asset, or percentage of your estate.

HOW IT WORKS:

1. You arrange for a gift to the MBL in your will or living trust, or name the MBL as a beneficiary of your life insurance policy or retirement plan.

2. Your gift is distributed to the MBL upon your death.

BENEFITS:

› Flexible—you can make changes to your bequest at any time

› Revocable—you remain in control of your assets during your lifetime

› Tax deductible—your bequest is fully deductible for estate tax purposes

You can decide how your bequest benefits the MBL. Contact us for sample bequest language that will help you, your legal adviser, or your financial planner communicate your wishes.

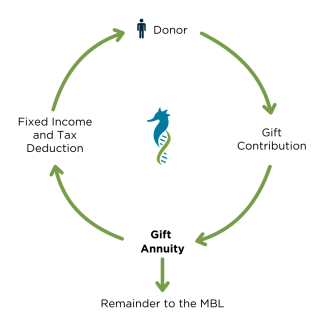

A charitable gift annuity is a contract with the MBL in which you make an irrevocable gift of cash or securities to the MBL in exchange for a fixed annual income for life.

HOW IT WORKS:

1. You contribute a minimum gift of $10,000 in cash or securities to the MBL.

2. The MBL makes fixed annual payments to you or your beneficiaries for life, starting either when the gift is made (immediate-payment annuity) or at a later date (deferred annuity).

3. Your gift benefits the MBL upon your death.

BENEFITS:

› Life income—you and/or your spouse, child, or other beneficiary receive income for life or a specified term of years

› Guaranteed payments—your payments are fixed and backed by the MBL

› Tax deductible—you receive an immediate deduction equal to the present value of the remainder gift to the MBL, with the potential for other tax savings

Annuitants must be 55+ to receive payments. The annuity rate is determined by the annuitant’s age.

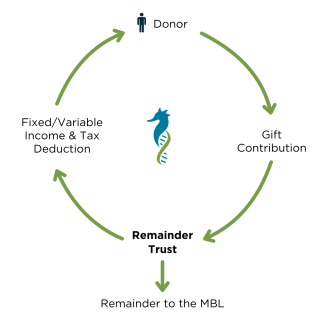

A charitable remainder trust is established by making an irrevocable transfer of cash, securities, or real estate to an MBL trust in exchange for fixed or variable annual income for life or a term of years.

HOW IT WORKS:

1. You transfer a minimum of $100,000 in cash, securities, or real estate to an MBL trust.

2. The trust pays you either a fixed percentage of its value (unitrust) or a fixed dollar amount (annuity trust) annually for life or a term of years.

3. Your gift benefits the MBL upon your death.

BENEFITS:

› Life income—you and/or your spouse, child, or other beneficiary receive income for life or a term of years

› Payment preference—you choose fixed or variable payments

› Tax deductible—you receive an immediate deduction equal to the present value of the remainder gift to the MBL, with the potential for other tax savings.

You may avoid paying capital gains tax on the appreciation by spreading your liability over a period of years.

Your payout rate is decided when the charitable remainder trust is established, typically around 5 percent. Annuitants must be 55+ to receive payments.

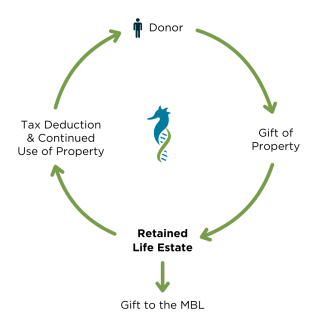

A retained life estate allows you to make a gift of real estate to the MBL without changing your current living situation. You can donate your primary residence or vacation home to the MBL and retain the use and responsibilities for life.

HOW IT WORKS:

1. You deed your property to the MBL, but retain the right to use it for life.

2. The MBL becomes the owner of the property upon your death.

3. The MBL sells the property, and the proceeds benefit the laboratory as you have intended.

BENEFITS:

› Continued use of property—you gift your property and continue to use it for life

› Avoids probate—your property passes directly to the MBL

› Tax deductible—you receive an immediate deduction equal to the present value of the remainder interest in the property, with the potential for other tax savings

Gifts of real estate are subject to review and approval in accordance with the MBL’s real estate acceptance procedures. Donor must provide detailed and specific information about the property.

Communicate Your Wishes:

Sharing your estate plans ensures that your wishes will be met, and allows us to express our gratitude during your lifetime while assisting the MBL’s long-term planning efforts. To document your bequest, please be prepared to provide the following:

› a copy of the portion of the will or trust document or beneficiary designation form referencing your planned gift to the MBL;

› a copy of the signature page;

› a copy of the page indicating the date of the document;

› an estimated value of the bequest, if not stated as a dollar amount in the document.

If the bequest is included as part of your and your spouse/partner’s estate plan and will not be realized until the death of the survivor, please include copies of your spouse/partner’s documents from the above list.

Documenting your bequest does not make it binding or irrevocable—you still have the liberty to revise your estate plan if your circumstances or priorities change.

The 1888 Society recognizes scientists and friends of the MBL who provide for the Laboratory’s future through bequests, life income gifts, charitable trusts, and gifts of real estate. If you have provided for the MBL in this way, or have questions, please let us know. Sharing your plans allows us to express our gratitude during your lifetime, ensures that your wishes for your gift will be met, and empowers the MBL to successfully plan for the future.

Do you want to know more?

Please contact Garrett Gryska to discuss bequests, life income gifts, gifts of retirement plan assets, and gifts of real estate.

Garrett Gryska

Senior Associate Director, Individual and Planned Giving

ggryska@mbl.edu

508-289-7171